BPCL SBI Credit Card vs IndianOil Kotak Credit Card

Fees & Charges

Rewards & Benefits

Travel & Lifestyle

Security & Other

BPCL SBI Credit Card

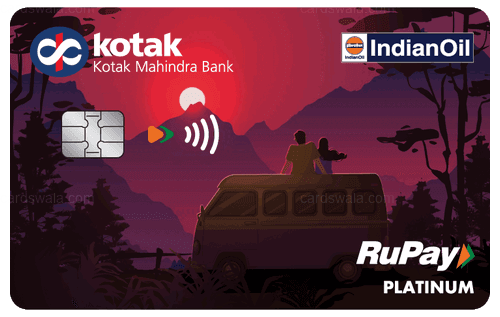

IndianOil Kotak Credit Card

Who is it for?

Who is it for?

Pros

Key benefits and features.

Offers great reward points and significant value back on fuel transactions at BPCL petrol pumps across India.

The BPCL SBI Card is highly accessible due to its competitive and low joining cost of just Rs. 499.

Provides attractive rewards on various everyday spending categories like groceries, dining, and movie tickets.

Pros

Key benefits and features.

Significant savings potential on IndianOil fuel purchases with a 5% value back.

Accelerated rewards on essential spends like dining and groceries enhance daily value.

Valuable welcome benefit of 1000 reward points on initial spend within 30 days.

Complimentary personal accident insurance cover of ₹2 Lakhs provides added security.

Annual fee waiver easily achievable by spending ₹50,000 yearly.

Cons

Key drawbacks and limitations.

Cardholders will not receive any complimentary domestic or international airport lounge access.

There are no specific insurance benefits or covers included as part of this credit card's offerings.

Reward points are not earned on transactions for mobile wallet uploads or fuel purchases outside BPCL stations.

Cons

Key drawbacks and limitations.

Monthly capping limits on reward points for fuel, dining, and grocery spends restrict maximum earnings.

Cashback redemption requires a minimum of 2000 points, potentially delaying benefits.

Higher foreign currency markup of 3.5% makes international spends less rewarding.

Various new fees on wallet, education, and utility effective from June 2025.

No complimentary domestic or international airport lounge access included with the card.